India Biogas Market Poised for Strong Growth, Expected to Reach USD 3.49 Billion by 2032 at 10.20% CAGR

Key companies covered in India biogas market report are Wärtsilä, Clarke Energy, GPS Renewable, Renergon International AG, Green Elephant Engineering Pvt. Ltd.

NY, UNITED STATES, February 9, 2026 /EINPresswire.com/ -- The India biogas market size was valued at USD 1.64 billion in 2024. The market is projected to be worth USD 1.77 billion in 2025 and reach USD 3.49 billion by 2032, exhibiting a CAGR of 10.20% during the forecast period. India has huge biogas potential, being the world’s most populous country and an agricultural powerhouse. Currently, more than 5 million bio-gas plants are operational in the country. Maharashtra, Gujarat, Karnataka, Uttar Pradesh, and Madhya Pradesh are the major plant operating states in India. Maharashtra had the largest number of plants (935,000) by March 2023. It has readily available feedstock volumes, which indicates that the country is capable of producing over 62MMT bio-CNG (~86BCM/yr).The India biogas market is witnessing strong momentum and is set to expand rapidly over the next decade, supported by increasing demand for clean energy, rising availability of organic waste, and favorable government initiatives promoting renewable fuels.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/india-biogas-market-106563

Rising Clean Energy Demand Driving Market Expansion-

India’s growing population, rapid urbanization, and expanding industrial base have resulted in higher energy consumption, accelerating the shift toward sustainable and renewable energy alternatives. Biogas has emerged as a viable solution due to its ability to convert organic waste into clean fuel while supporting circular economy goals.

The country generates vast quantities of agricultural residue, animal manure, and municipal solid waste, providing a consistent and low-cost feedstock base for biogas production. This availability significantly strengthens the long-term outlook for biogas projects across urban and rural regions.

Market Segmentation Analysis-

• By Feedstock:

o Agricultural waste holds a dominant share due to India’s large agrarian base and continuous availability of crop residues and animal manure.

o Municipal solid waste is gaining traction as urban waste management initiatives and waste-to-energy projects expand.

o Industrial organic waste contributes steadily, particularly from food processing and agro-based industries.

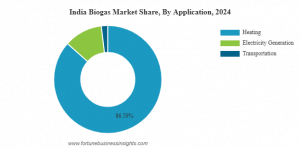

• By Application:

o Heating remains the leading application, driven by widespread use of biogas for cooking and industrial thermal energy.

o Electricity generation is witnessing steady growth as biogas plants are increasingly integrated with captive and grid-connected power systems.

o Transportation is an emerging segment, supported by the rising adoption of compressed biogas (CBG) as a cleaner alternative to conventional fuels.

• By Technology:

o Anaerobic digestion dominates the market owing to its cost-effectiveness and suitability for diverse organic feedstocks.

o Advanced digestion and upgrading technologies are gaining attention to enhance gas yield and improve operational efficiency.

Heating Applications Dominate Market Demand-

By application, the market is primarily driven by heating, as biogas is widely used for cooking and industrial heating purposes. At the same time, demand for electricity generation and transport fuel applications, particularly compressed biogas for vehicles, is rising steadily as infrastructure improves and policy support increases.

Challenges Remain Despite Positive Growth Trends-

Despite its strong growth potential, the biogas market faces challenges related to high initial capital investment, limited access to advanced technologies, and inadequate waste segregation systems in certain regions. Addressing these barriers will be critical to accelerating large-scale adoption and improving operational efficiency.

Speak To Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/india-biogas-market-106563

Regional Insights-

• Western India:

o Leads the market due to high concentration of agricultural activity, strong industrial base, and early adoption of renewable energy projects.

o Maharashtra and Gujarat emerge as key contributors, supported by state-level incentives and infrastructure readiness.

• Northern India:

o Shows strong growth potential driven by large volumes of agricultural residue and increasing government focus on stubble management.

o States such as Uttar Pradesh are witnessing increased biogas plant installations under rural and urban waste-to-energy programs.

• Southern India:

o Demonstrates steady adoption supported by technological awareness and industrial demand.

o Karnataka and Tamil Nadu benefit from organized waste management systems and private sector participation.

• Eastern and North-Eastern India:

o Remain at a nascent stage but present long-term opportunities due to untapped biomass resources.

o Market growth is expected to accelerate with improved infrastructure and policy implementation.

Report Coverage-

• Provides a comprehensive analysis of the India biogas market size, growth trends, and future outlook.

• Covers detailed segmentation by feedstock, application, and technology.

• Examines key growth drivers, restraints, and emerging opportunities shaping market dynamics.

• Includes competitive landscape assessment with strategic profiling of major market participants.

Competitive Landscape-

• The India biogas market is moderately fragmented, with the presence of domestic players, engineering firms, and international technology providers.

• Key companies are focusing on plant capacity expansion, long-term feedstock contracts, and collaborations with municipalities and agricultural cooperatives.

• Major market participants include:

o GAIL, strengthening its presence in compressed biogas and gas distribution integration

o GPS Renewables, actively developing large-scale waste-to-energy and CBG projects

o Bharat Bio Gas Energy Ltd, focusing on rural and industrial biogas plant installations

o Wärtsilä, providing advanced biogas power generation solutions

o Clarke Energy, offering gas engine-based power systems for biogas projects

𝐁𝐫𝐨𝐰𝐬𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐒𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐓𝐎𝐂: https://www.fortunebusinessinsights.com/toc/india-biogas-market-106563

List of Top Companies-

• GAIL (India)

• Wärtsilä (Finland)

• Clarke Energy (U.K.)

• GPS Renewable (India)

• Primove Engineering Pvt. Ltd (India)

• Bharat Bio Gas Energy Ltd (India)

• KIS Group (India)

Key Industry Developments-

• June 2024: Indian Oil Corporation entered a joint venture with GPS Renewables to promote the use of biofuel in India. This collaboration aims to leverage advanced bio-gas technologies to reduce greenhouse gas emissions and offer sustainable alternatives to fossil fuels. Additionally, this partnership will support Indian Oil's objective of reaching a net-zero target by 2070.

• April 2024: GPS Renewables, a Bangalore-based cleantech startup, raised USD 50 million in a debt financing round from a cluster of banks and Non-Banking Financial Companies (NBFCs). The newly raised capital will help the company expand its footprint and increase its fuel expansion efforts. Moreover, it will be used for the nationwide establishment of compressed plants.

Related Reports-

Liquid Biofuels Market Size, Industry Share

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.